When you’re switching health plans, the biggest mistake most people make is focusing only on monthly premiums. You might pick the cheapest plan - only to get hit with a $150 bill for your monthly blood pressure pill. That’s because generic drug coverage can make or break your annual drug costs. It’s not just about whether your medicine is covered. It’s about which tier it’s in, whether you have to meet a deductible first, and if your pharmacy is in-network.

Why Generic Drugs Matter More Than You Think

Generic drugs make up 90% of all prescriptions filled in the U.S., but they only account for 23% of total drug spending. That’s because they cost way less than brand-name versions - sometimes 80-90% less. But if your health plan doesn’t cover them well, you’re still paying too much.

Take metformin, the most common diabetes medication. A 30-day supply can cost $4 at a preferred pharmacy under a good plan. Under a bad one? It could be $40 - or even $100 if you haven’t met your deductible yet. The difference isn’t the drug. It’s the plan’s formulary.

Formularies are the lists of drugs your plan covers, sorted into tiers. Tier 1 is almost always generic drugs. Tier 2 is brand-name drugs that have generic equivalents. Tier 3 and 4 are higher-cost drugs, often specialty medications. The lower the tier, the lower your out-of-pocket cost.

How Formulary Tiers Work Across Different Plans

Not all plans are built the same. Here’s how they break down:

- Marketplace plans (ACA): Most use a 4-tier system. Tier 1 generics usually have a $3-$20 copay. Silver plans with Special Design (SPD) waive the deductible for Tier 1 drugs - meaning you pay just $20 per script, even if you haven’t met your medical deductible. This is huge if you take multiple meds.

- Medicare Part D: In 2025, the deductible is capped at $505, but many plans have $0 or $10 copays for preferred generics. Non-preferred generics can cost $20-$40. Some plans split generics into two tiers: Tier 1 (preferred) and Tier 1+ (non-preferred). Your levothyroxine might be $0 in one plan and $15 in another - even though they’re the same drug.

- Employer plans: These vary wildly. Some charge $5 for generics before you meet your deductible. Others make you pay full price until you hit $2,000 or more. Check your summary of benefits - don’t just assume.

- High-deductible health plans (HDHPs): These look cheap on paper, but if your plan combines medical and prescription deductibles, you’ll pay full price for every pill until you hit that high number. For someone on three generics a month, that could mean $500+ in out-of-pocket costs before coverage kicks in.

State Rules Change Everything

Where you live matters more than you realize. California requires a $85 outpatient drug deductible before generics are covered - then you pay 20% coinsurance, capped at $250 per year. New York? No deductible for generics. You pay a flat $7 copay. DC has a $350 separate drug deductible. Florida? No state rules - so your plan’s terms rule.

If you’re moving states or switching plans within a state, don’t assume your current drug costs will stay the same. A medication that cost $5 last year could jump to $25 if your new plan doesn’t cover your specific brand of generic.

What You Must Check Before Switching

You can’t just look at the tier. You need to dig deeper. Here’s your checklist:

- Get the full formulary - not just the summary. Look up every drug you take, including strength (e.g., 500mg metformin vs. 1000mg).

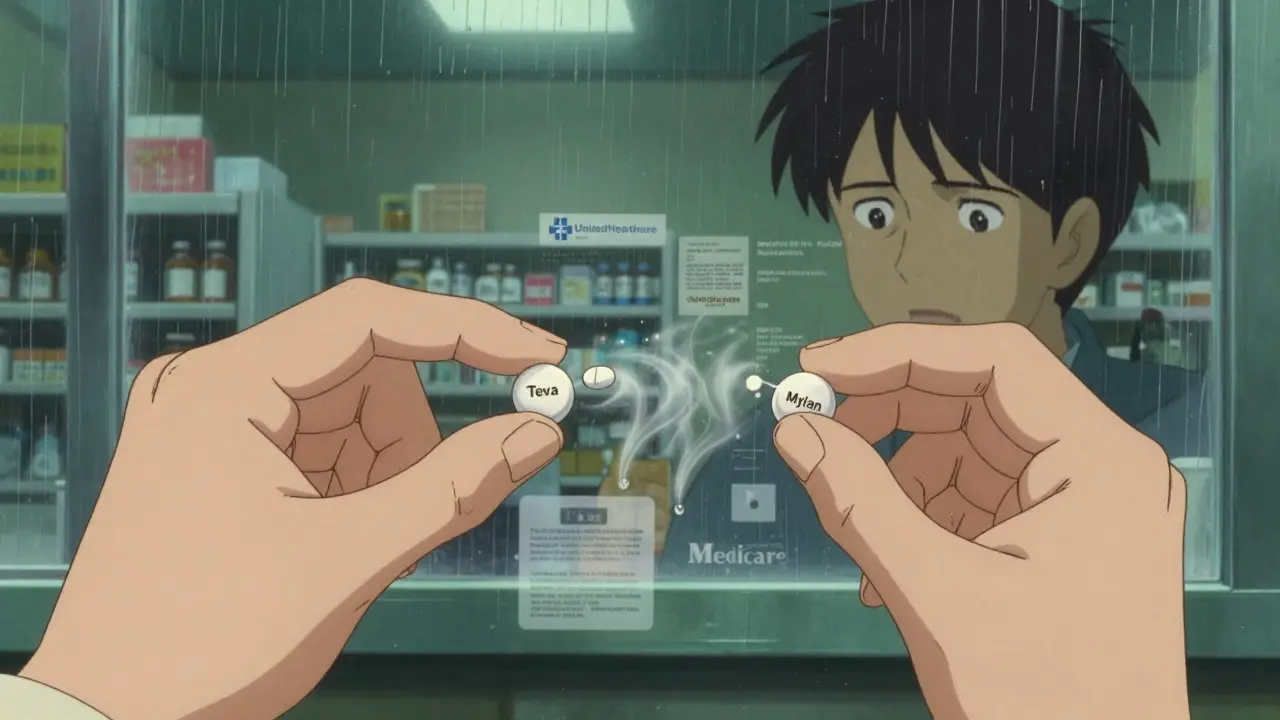

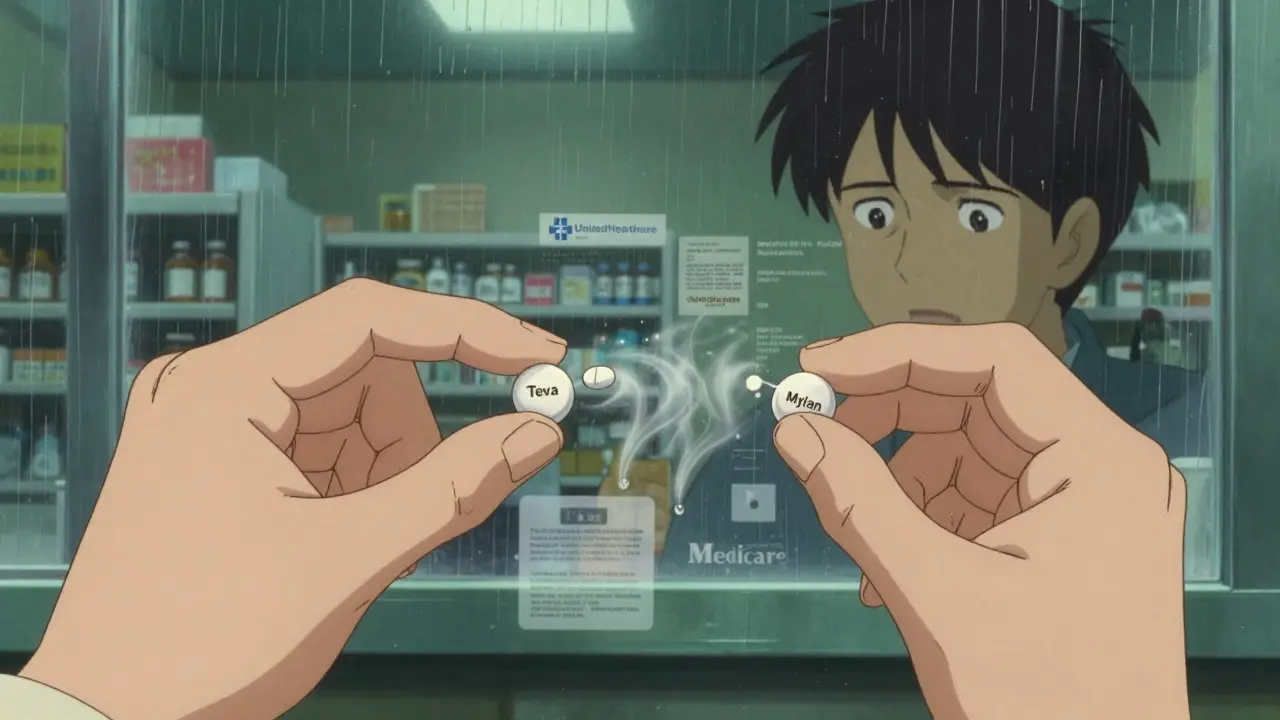

- Check the manufacturer. Metformin made by Teva might be Tier 1. Metformin made by Mylan might be Tier 2. Same active ingredient. Different cost.

- Verify your pharmacy. If your go-to pharmacy isn’t in-network, your $3 generic could cost $15. Use your plan’s pharmacy locator tool.

- Calculate annual cost. Multiply your monthly copay by 12. Add any deductible you must meet. Don’t forget mail-order options - they often cost less.

- Compare with your current plan. Use the Medicare Plan Finder or Healthcare.gov’s tool. Input your exact meds. It will show you the real cost difference.

Real Stories, Real Savings

One user switched from a UnitedHealthcare plan to a Blue Cross plan in Massachusetts. Their three generics - metformin, lisinopril, and atorvastatin - went from $15 each to $3 each. Annual savings: $780.

Another person on Medicare switched from a standalone Part D plan to a Medicare Advantage plan with drug coverage. Their levothyroxine went from $12 to $0. Why? The Advantage plan had it as a preferred generic. They didn’t know until they used the Plan Finder.

But then there’s the flip side. A Reddit user in Texas switched plans and didn’t check the formulary. Their generic Adderall was covered - but only under a different manufacturer. The new one gave them headaches. They had to pay $120 out of pocket to switch back to their old brand.

Tools That Actually Work

Don’t guess. Use these tools:

- Medicare.gov Plan Finder - free, official, and accurate. Enter your drugs, zip code, and pharmacy. It shows you total annual cost for every plan.

- Healthcare.gov Plan Selector - for marketplace plans. Filters by drug coverage.

- Insurer’s own formulary tool - often more detailed than the public site. Look for “Drug Search” or “Formulary Lookup” on your insurer’s website.

- eHealthInsurance’s calculator - processes over a million queries a month. Great for comparing multiple plans side by side.

These tools aren’t perfect, but they’re 78-96% accurate. The ones built by insurers are usually the most reliable.

What Experts Warn You About

Dr. Karen Pollitz from KFF says the Silver SPD plans - which waive deductibles for generics - are the most important consumer protection since the Affordable Care Act. If you take regular meds, these plans can save you $1,200 a year.

The Medicare Rights Center found that 15% of beneficiaries lose coverage for their generic meds during plan switches. Antihypertensives and diabetes drugs are most likely to be dropped. That’s not a glitch - it’s a common practice.

And here’s the kicker: 68% of people switching plans don’t check if their specific generic formulation is covered. They assume “metformin” is “metformin.” It’s not. If your plan drops your manufacturer, you might pay 5x more.

What’s Changing in 2025

The Inflation Reduction Act is making big changes:

- Insulin is capped at $35/month - no matter your plan.

- Medicare Part D will have a $2,000 annual out-of-pocket cap starting in 2025.

- More Silver SPD plans are being offered - 32 states now, up from 24 in 2023.

- Medicare will split generics into two tiers: preferred and non-preferred. This means more people will pay more for the same drug.

AI tools like the new CMS-endorsed “Medicare Plan Scout” are also rolling out. In testing, they cut enrollment errors by 44%. If you’re confused, use them.

Final Advice: Don’t Skip This Step

Switching health plans is a big decision. But the real cost isn’t in your monthly premium. It’s in your pill bottle.

If you take even one generic drug regularly, spend 30 minutes checking the formulary. Don’t wait until you’re at the pharmacy counter. Don’t assume your old plan’s coverage carries over. Don’t trust a sales rep’s word.

Use the tools. Input your exact meds. Compare total annual cost - not just copays. The right plan can save you hundreds, even thousands. The wrong one? You’ll pay for it every month.

Frequently Asked Questions

Do all health plans cover generic drugs?

Yes, all qualified health plans must cover at least some generic drugs - but not all generics, and not at the same cost. Some plans put certain generics in higher tiers or require you to meet a deductible before coverage starts. Always check the full formulary.

Why is my generic drug more expensive on my new plan?

It’s likely because your plan uses a different manufacturer. Even though the active ingredient is the same, insurers treat different brands of generics differently. One might be Tier 1 ($5 copay), another Tier 2 ($25). Always check the manufacturer name on the formulary.

Should I pick a plan with a lower premium but higher drug costs?

Only if you don’t take any medications. If you take even one generic drug monthly, a low-premium plan with high copays or a high deductible can cost you more overall. Always calculate your total annual drug cost - premium + copays + deductible - not just the monthly payment.

Can I switch plans mid-year to get better generic coverage?

Generally, no - unless you qualify for a Special Enrollment Period (SEP). Common SEPs include moving to a new state, losing other coverage, or gaining eligibility for Medicare. Outside of these, you must wait for Open Enrollment. If your meds suddenly become unaffordable, contact your insurer - some offer temporary exceptions.

What if my generic drug is removed from the formulary?

Your plan must notify you at least 60 days before removing a drug. You can request a formulary exception - a process where you ask the plan to cover your drug anyway. Your doctor must support it with a letter explaining why you need that specific version. Many requests are approved, especially for chronic conditions.

Are mail-order pharmacies better for generics?

Often yes. Many plans offer lower copays for 90-day supplies through mail-order. For example, a $10 copay for a 30-day supply at a retail pharmacy might drop to $25 for a 90-day supply by mail. That’s a 25% savings. Check if your plan has a preferred mail-order pharmacy.