Not all generic drugs are created equal. While you might think a generic version of a brand-name medicine is just a cheaper copy, that’s not true for complex generic drugs. These aren’t simple pills with one active ingredient. They’re liposomal injections, inhalers with precise dosing mechanisms, long-acting injectables, or peptide-based therapies. And getting them approved by the FDA? It’s not just harder-it’s often a multi-year battle with a high chance of failure.

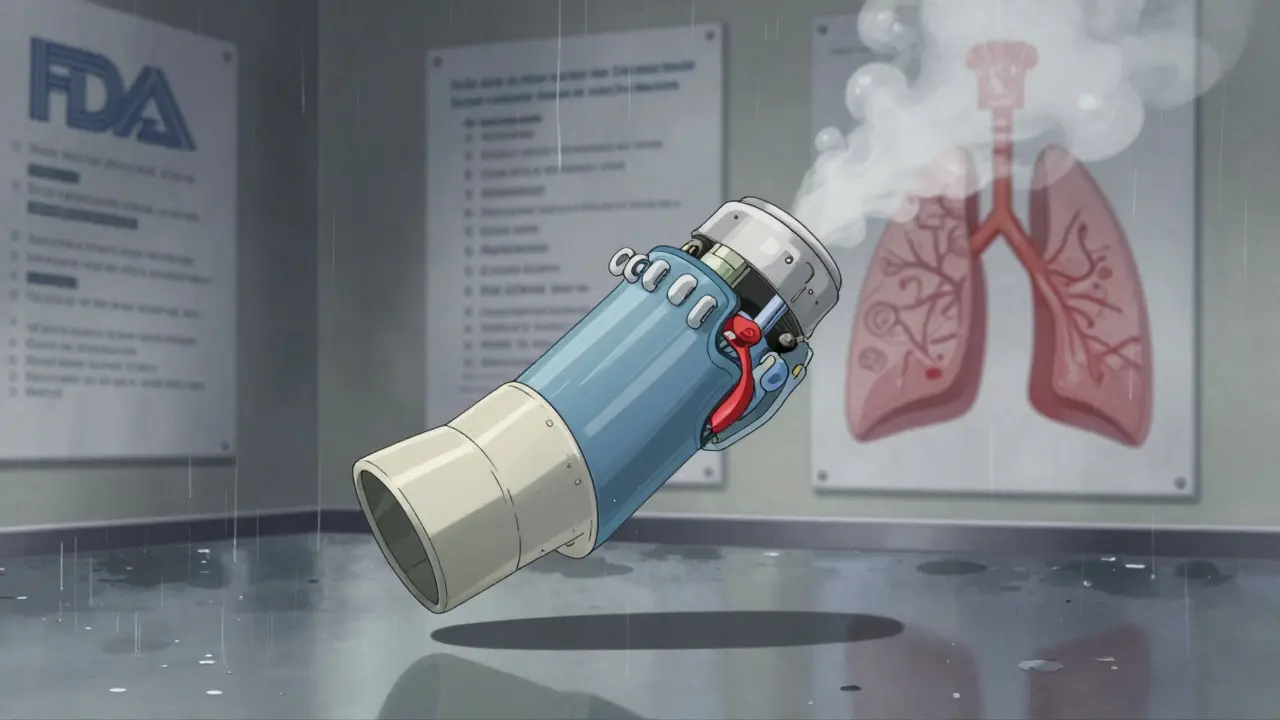

The FDA defines complex generic drugs by their scientific makeup. It’s not about the name or the dose-it’s about how the drug is built. A simple generic might be a tablet with one chemical compound, like metformin. A complex generic could be a liposomal bupivacaine injection, where the drug is wrapped in tiny fat bubbles to control how slowly it releases into your body. Or it could be an inhaler that delivers medication deep into the lungs, where even a 5-micron difference in the device’s nozzle can change how much medicine reaches the patient.

These products fall into five main categories:

Each of these requires specialized manufacturing, advanced testing, and completely different ways to prove they work the same as the brand-name version. That’s where things get messy.

For traditional generics, the FDA relies on a straightforward test: bioequivalence. You give the generic and the brand-name drug to healthy volunteers, measure how much drug enters the bloodstream, and if the levels are within 80-125% of each other, it’s approved. Simple.

But for complex generics, that method doesn’t work. Take a liposomal injection: the drug isn’t just floating in your blood. It’s trapped inside fat bubbles that slowly break down over days or weeks. Measuring total drug in the blood doesn’t tell you if the *right amount* is being released *at the right time*. The FDA had to invent new ways to test this. For the first-ever approved complex generic-bupivacaine liposome injectable in 2019-the agency required a combination of advanced imaging, animal studies, and pharmacokinetic modeling just to prove it behaved like the brand product.

And that’s just one product. For inhalers, the device itself matters as much as the drug. If the valve pressure is off by 1%, the patient might get too little medicine-or too much. But the FDA can’t just say, “It’s close enough.” Even tiny differences in the plastic casing or airflow design can trigger rejection. That’s why some complex generics sit on the shelf for years, even after the brand patent expires.

One of the biggest problems? Uncertainty. In 2017, the FDA launched GDUFA II, a program meant to speed up complex generic approvals. It promised more staff, faster reviews, and clearer guidance. And it did help-but not enough.

The FDA now has over 1,700 Product-Specific Guidances (PSGs) to help manufacturers know what to submit. But here’s the catch: these documents change. A company might spend $30 million developing a generic inhaler based on a 2020 guidance, only to have the FDA update the requirements in 2023. Suddenly, their entire testing plan is outdated. No one’s at fault-it’s science evolving. But for a small generic company, that’s a financial death sentence.

And then there’s the Pre-ANDA Meeting Program. It lets companies sit down with FDA scientists before submitting an application. By 2023, over 1,200 of these meetings had been held. That sounds good-until you realize most of them are still followed by months of back-and-forth emails, additional data requests, and revisions. One manufacturer told analysts they spent 18 months just getting the FDA to agree on what tests to run.

Developing a simple generic takes 2-3 years and costs $1-5 million. A complex generic? It can take 5-7 years and cost $20-50 million. That’s not just a bigger budget-it’s a different kind of business.

Most generic companies are used to high-volume, low-margin products. Complex generics demand R&D teams with PhDs in pharmacokinetics, analytical chemists with access to $500,000 mass spectrometers, and regulatory experts who speak FDA’s jargon fluently. Only a handful of companies can afford it. That’s why, despite over 1,000 simple generics approved between 2015 and 2023, only 15 complex generics made it through.

And even when they do get approved, the payoff isn’t guaranteed. If the brand-name drug is already facing competition from other generics, the price drops fast. A complex generic might launch at $10,000 per dose, but within a year, it could be down to $3,000. That’s still cheaper than the brand-but the profit margin is razor-thin. Many companies walk away before they even submit an application.

The U.S. isn’t the only place with tough rules. In China, the National Medical Products Administration (NMPA) requires local clinical trials and a local legal agent. That adds 6-12 months and another $5 million in costs. Brazil’s ANVISA demands certification of every lab and clinical site using ICH guidelines-something many small manufacturers can’t afford. Even in the EU, regulators often demand extra studies for complex products that aren’t required for simple generics.

So a company might spend $40 million to get approval in the U.S., only to find out they need another $15 million to enter Europe. That’s why many complex generics are only available in the U.S.-even when patients elsewhere need them.

There are signs of progress. The FDA is investing in AI and machine learning to predict how a complex drug will behave in the body, reducing the need for endless animal and human trials. Quality-by-design approaches-where manufacturers build in controls from day one-are cutting review times by 35-45% for well-documented products.

The bupivacaine liposome approval in 2019 proved it’s possible. It took seven years and dozens of meetings, but it happened. Since then, the FDA has approved a few more-like a generic version of a long-acting injectable antipsychotic in 2022.

And the market is pushing forward. By 2028, complex generics could make up 25% of the $250 billion global generic drug market. That’s because big-name drugs like Humira, Enbrel, and Humalog are losing patent protection-and they’re all complex products. If generics don’t come in, patients will keep paying $10,000 a year for insulin or biologics.

It’s easy to think, “If it’s generic, it’s cheap and available.” But for patients with chronic conditions-diabetes, arthritis, asthma, mental illness-complex generics are often the only affordable option. Without them, they’re stuck with branded drugs that cost 10x more.

And it’s not just about price. Some complex generics offer better safety. A liposomal version of a painkiller might reduce side effects by releasing slowly. A better inhaler design might mean fewer hospital visits. But if regulators don’t approve them, those benefits never reach patients.

The FDA knows this. They’ve said so in public statements. But fixing the system isn’t about hiring more staff or writing more guidance. It’s about changing how they think. Instead of comparing every detail to the brand product, can they focus on what actually matters to the patient? Can they accept a broader range of data? Can they trust manufacturers who have the right science?

Right now, the system is built for simple pills. But medicine is moving beyond pills. And if the approval process doesn’t catch up, patients will keep paying the price.

The FDA uses the same bioequivalence test for all generics, but that test doesn’t work for complex products. A liposomal injection or inhaler doesn’t release the drug the same way a pill does. Measuring total drug in the blood doesn’t tell you if the medicine is working properly in the body. For these products, the FDA needs new science-advanced imaging, modeling, device testing-which takes years to develop and validate. That’s why reviews take longer.

They’re not designed to be better-they’re designed to be the same. But sometimes, a generic version ends up being safer because manufacturers improve the formulation. For example, a generic inhaler might use a more stable propellant that reduces lung irritation. Or a liposomal generic might release the drug more evenly, lowering side effects. The FDA only requires equivalence, but better design can happen along the way.

The cost and risk are too high. Developing a complex generic can cost $20-50 million and take 5-7 years. If the FDA rejects the application after all that, the company loses everything. Most generic manufacturers are small and can’t afford that kind of gamble. Big pharma companies avoid them too-they’re focused on new drugs, not generics. So only a few players with deep pockets and scientific expertise are willing to try.

Yes. Even after FDA approval, manufacturing complex products is harder. Liposomal injectables require sterile facilities with exact temperature controls. Inhalers need precision assembly lines. Many companies don’t have the infrastructure, so scaling up takes months or years. Plus, insurers and pharmacies often don’t prioritize these drugs because they’re still expensive compared to simple generics. So approval doesn’t mean immediate access.

The FDA has improved-more guidance documents, Pre-ANDA meetings, and specialized staff. But the system is still slow and unpredictable. Companies report that guidance changes mid-development, and reviewers often ask for new data not mentioned in prior meetings. The FDA admits complex generics are a high-priority challenge, but without fixed standards and faster decision timelines, progress will remain slow. Real change will come when regulators start trusting science over perfection.

Honestly the FDA is just scared to approve anything that isn't a sugar pill. They'd rather let patients bleed money than risk a single micrometer of deviation. Science isn't about perfection it's about function.

This is such an important issue-and I’m so glad someone’s talking about it. The FDA’s rigid, outdated frameworks are literally costing lives. We need to stop treating complex delivery systems like they’re just ‘another pill.’ The science is here. The patients are waiting. Let’s stop letting bureaucracy win.

America invented modern pharma and now we let bureaucrats choke innovation because they cant spell pharmacokinetics? Other countries are laughing at us. We could be leading the world but instead we got a paper pusher with a clipboard and a 1998 laptop

i just want to say thank you for writing this. as someone who’s been on a liposomal med for 5 years, i never realized how much work went into making it affordable. it’s not just about money-it’s about dignity. when your treatment costs less than your rent, you feel seen.

Wait so if the drug is in fat bubbles how do they even test it properly i mean like do they just guess or what

I’ve worked in a lab that made inhalers-tiny valve changes can mean the difference between a patient getting relief or ending up in A&E. The FDA’s not being difficult, they’re just trying not to kill someone. But yeah, the process is broken. We need smarter standards, not more paperwork.

So we’re saying the FDA is basically playing Jenga with people’s lives? One wrong move and the whole thing collapses. Meanwhile, patients are stuck paying $10k for insulin because the system is too scared to let a $50M bet pay off. We’re not protecting safety-we’re protecting fear.

The regulatory paradigm for complex generics remains anchored in pharmacokinetic equivalence, which is fundamentally inadequate for delivery-system-dependent therapeutics. The absence of validated surrogate endpoints and the lack of harmonized analytical methodologies across jurisdictions create systemic inefficiencies that impede market entry.

This isn’t just about drugs. It’s about trust. We built a system that worships perfection… but life isn’t perfect. The liposome doesn’t need to be identical to the brand-it needs to heal. The inhaler doesn’t need to match the nozzle down to the nanometer-it needs to get breath into lungs. The FDA isn’t broken. It’s just forgotten what it’s for. 🌱💊

i think the real problem is we think every drug has to be the same. maybe we need to let some generics be a little different-better even. if a cheaper version helps more people live better, why are we arguing about 2% variance in a fat bubble? peace not perfection