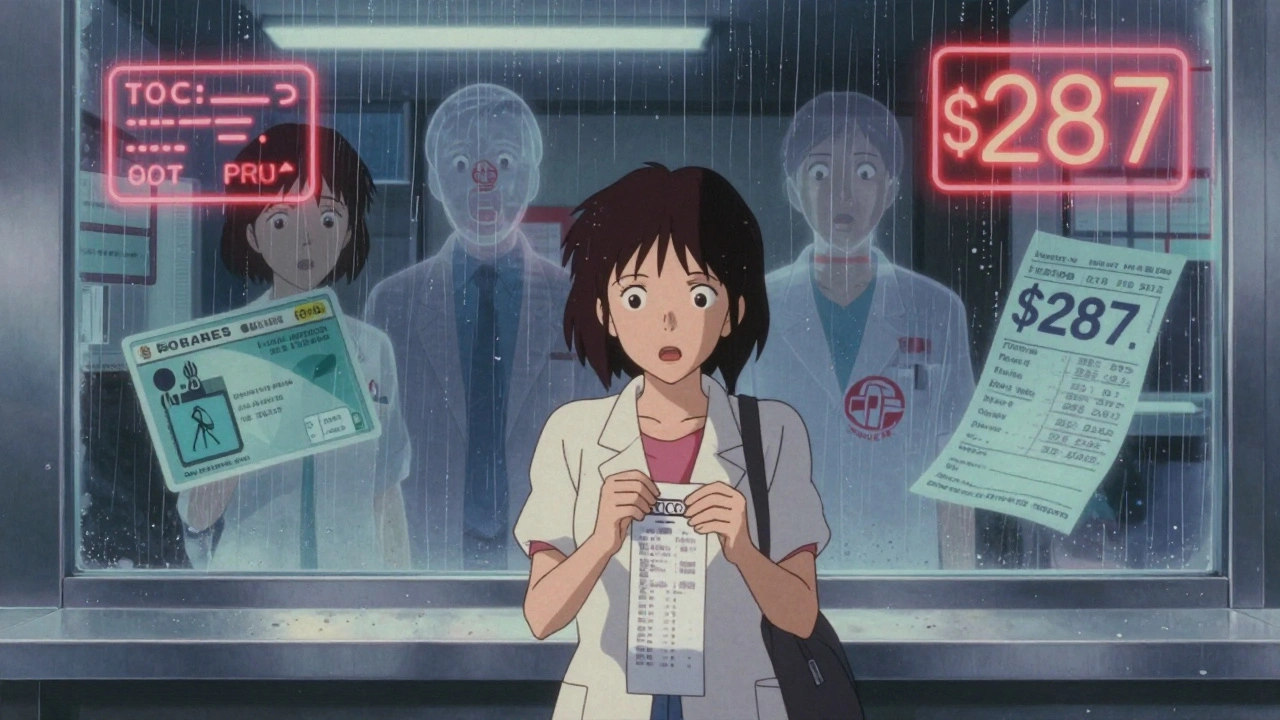

Imagine this: you walk into your local pharmacy to pick up a prescription your doctor just wrote. You hand over your insurance card, expect to pay your usual $20 copay, and then the cashier tells you it’s $287. You didn’t get a notice. You didn’t get a call. You didn’t even know the pharmacy wasn’t in your network. That’s not a mistake - it’s the new normal for millions of people with health insurance in the U.S.

The No Surprises Act was supposed to protect you from unexpected medical bills. It works for hospital visits, emergency care, and even surprise anesthesiologist charges. But here’s the catch: it doesn’t cover your prescriptions. Pharmacy benefits operate under a completely different system - one with no federal safety net. That means you can be stuck with a bill five times higher than expected, and there’s nothing automatic to stop it.

Your health plan isn’t one single network. It’s two: one for doctors and hospitals, and another - often hidden - for pharmacies. The pharmacy side is managed by a pharmacy benefit manager (PBM), companies like CVS Caremark, Express Scripts, or OptumRx. These PBMs negotiate prices with drug manufacturers and decide which pharmacies get to be "in-network."

Here’s how it breaks down: your doctor’s office might be in-network, your hospital might be in-network, but the pharmacy you’ve used for years? Not necessarily. And unless you check, you won’t know until you’re at the counter. Even if you’re on Medicare Part D, the same rule applies. The network for your specialist’s office and your pharmacy are two separate lists.

According to the Kaiser Family Foundation, 92% of large employers use separate PBMs to handle prescriptions. That means your insurance company doesn’t even control your pharmacy network directly. The PBM does. And they’re not required to tell you ahead of time if a pharmacy isn’t covered - even if you’ve been going there for years.

At an in-network pharmacy, you pay a copay - maybe $10, $20, or $50 depending on your plan. At an out-of-network pharmacy? You pay the full retail price. Then you try to get reimbursed. And even then, reimbursement is often less than what you paid.

Real numbers: a 30-day supply of a common medication like metformin costs $12 at an in-network pharmacy. At an out-of-network one? $147. That’s not a typo. A 2023 Kaiser survey found 28% of commercially insured adults paid unexpected pharmacy bills in the past year. Over half of those bills were over $100. One in five were over $500.

Specialty drugs - the ones for conditions like rheumatoid arthritis, multiple sclerosis, or cancer - are even worse. Many plans require you to use specific specialty pharmacies. If you go to a regular CVS or Walgreens instead? You could be looking at a $5,000 bill instead of a $50 copay. And there’s no law saying you have to be warned.

You can’t rely on your doctor’s office, your pharmacy, or your insurance app to do this for you. You have to take action. Here’s how:

Pro tip: If you’re switching pharmacies, call your insurance first. Don’t wait until you’re in line. One woman in Ohio paid $420 for insulin because she didn’t check - her old pharmacy was in-network, but the new one down the street wasn’t. She had to pay out of pocket and then fight for reimbursement for months.

Even if you did everything right, mistakes happen. A pharmacy might miscode your insurance. Your plan might have changed your network without telling you. Here’s what to do:

One man in Florida had his $800 specialty drug claim denied because his pharmacy wasn’t listed in the system. He called his PBM, found a nearby in-network specialty pharmacy, got the script transferred, and had the original bill reversed - but only after 47 days of stress.

If you take a specialty medication - anything over $600 a month - you’re at higher risk. These drugs are often restricted to just one or two specialty pharmacies. Your plan might require prior authorization just to fill them. If you go to a regular pharmacy, you’ll be denied or charged full price.

Check your plan’s formulary - the list of covered drugs. Look for the "specialty pharmacy requirement" note. If it says "must use CVS Specialty or Express Scripts Specialty," then you have no choice. But here’s the kicker: those specialty pharmacies aren’t always easy to find. They might be in a different city. You might need to mail-order. And if you don’t know, you’ll get hit with a surprise bill.

Dr. Karen Van Nuys from USC’s Schaeffer Center says patients on specialty drugs often pay 3 to 5 times more than they should - just because they didn’t know where to go. Don’t be one of them. Call your PBM and ask: "Which specialty pharmacies are in my network for my medication?" Write it down.

There’s growing pressure to fix this. The Pharmacy Benefit Manager Transparency Act (H.R. 5827), introduced in 2023, would require PBMs to show real-time pharmacy network status at the point of sale. The Biden administration proposed $25 million in 2024 to study solutions. States like California and New York are drafting laws to extend surprise billing protections to prescriptions.

But as of now, nothing has passed. The federal government still says pharmacy benefits are outside the scope of the No Surprises Act. That means the burden is on you.

And it’s not just about money. It’s about trust. People stop taking their meds because they can’t afford the bill. A 2022 Patient Advocate Foundation report found that 31% of people who faced a surprise pharmacy bill skipped doses or didn’t fill their prescription at all.

The system is broken. There’s no federal shield for pharmacy bills. No automatic protection. No law that says you must be warned. The only thing standing between you and a $500 surprise is your own action.

Check your pharmacy network before you fill any prescription. Use your PBM’s app. Call customer service. Don’t trust the front desk. Don’t assume your pharmacy is covered. And if you’re on a specialty drug? Triple-check.

This isn’t about being overly cautious. It’s about survival. Your health depends on your meds. Don’t let a hidden network rule cost you your peace of mind - or your money.

This is why I stopped trusting insurance companies entirely. I swear they’re in cahoots with PBMs to screw people over. I once got billed $900 for a $30 pill because the pharmacy ‘messed up’ my plan code. They didn’t apologize. They didn’t refund me. They just said ‘next time check your network.’ Like I’m supposed to memorize a secret list that changes every month? This isn’t healthcare. It’s a pyramid scheme with pills.

And don’t even get me started on how PBMs make money off the spread. They buy drugs cheap, charge you full price, then pocket the difference. It’s legal theft. The government lets them do it because they donate to both parties. Wake up, people.

I’ve started buying my meds from Canada now. Yeah, it’s a hassle. Yeah, it takes 2 weeks. But I pay $12 for insulin instead of $400. And no one’s asking me for my insurance card. They just take my cash and hand me the box. No drama. No fine print. Just medicine. If you’re not doing this yet, you’re being played.

I’ve started a Reddit group called ‘Pharmacy Bill Survivors.’ We share screenshots, PBM names to avoid, and pharmacies that still work. Join us. We don’t just complain-we fight back.

Thank you for this incredibly clear and vital breakdown. As someone who manages chronic illness care for elderly family members, I can’t emphasize enough how critical it is to verify pharmacy networks independently. Even when we believe we’ve done due diligence, systems change without notice.

I recommend printing out the pharmacy network list from your insurer’s website and keeping it in your wallet alongside your insurance card. It’s a small habit that can prevent catastrophic financial surprises. Also, always ask the pharmacist to confirm the network status aloud-many don’t realize how often they’re misinformed themselves.

For Medicare beneficiaries, the Plan Finder tool is indispensable. Use it every fall during open enrollment. Don’t assume your current pharmacy will remain in-network. The difference between $15 and $500 is real-and preventable.

OMG I JUST HAD THIS HAPPEN 😭 I went to Walgreens for my thyroid med and got slapped with a $387 bill. I cried in the parking lot. I didn’t even know my PBM switched networks last month. I’m so mad.

But then I downloaded the CVS Caremark app (I’m on that one) and it showed me a pharmacy 3 blocks away that was in-network for $12. I went back the next day, got it filled, and they refunded me after I filed a dispute. IT WAS SO EASY ONCE I KNEW WHAT TO DO.

PLS DO THE THING. DOWNLOAD THE APP. CALL YOUR PBM. DON’T LET THEM ROB YOU. YOU DESERVE TO TAKE YOUR MEDS WITHOUT GOING BROKE 💪❤️

Lmao you think this is bad? In India, we pay 10 rupees for insulin. No network. No PBM. No drama. Just medicine. Here, you need a PhD in insurance law just to buy aspirin. The US healthcare system is a joke. PBMs are the real villains. They’re not even real companies-they’re shell corporations owned by hedge funds. And you? You’re just a cash cow. 🤡

Stop trusting ‘doctors’ and ‘pharmacists.’ They’re just middlemen in a rigged game. Go to Mexico. Or Canada. Or just buy generic from Amazon. At least you won’t get scammed by a 100-page terms-of-service document.

Big shoutout to the OP for laying this out so clearly. As a health tech consultant, I’ve seen the PBM infrastructure from the inside-and yeah, it’s a mess. But here’s the pro tip: use the ‘Drug Price Lookup’ feature in your PBM app. It’s buried under ‘My Benefits,’ but it shows you real-time copays across all in-network locations.

Also, if you’re on a specialty drug, call your PBM and ask for the ‘Specialty Pharmacy Routing Guide.’ They’ll send it to you. It’s not on the website. They don’t advertise it. But it exists.

And don’t panic if you get a surprise bill. Call the PBM within 30 days. Say: ‘I’d like to initiate a reprocessing request under the Pharmacy Billing Error Protocol.’ They’ll usually reverse it. You just have to know the right words. 💡

I’ve been there. I skipped my RA meds for 3 months because I got a $1,200 bill and thought I couldn’t afford it. I felt so guilty. I thought I was weak.

Then I found a patient advocacy nonprofit that helped me dispute it. They walked me through the process. I got 90% back. And now I check my pharmacy network every time I refill-even if it’s the same place.

You’re not alone. And you’re not failing. The system is broken. But you can still protect yourself. Take a breath. Grab your phone. Open your insurance app. Do it now. You’ve got this. ❤️

Wow. So you’re telling me… we’re supposed to… check… a… list…?

And not just once. Every. Single. Time.

That’s it. That’s the entire solution. Just… check. A. List.

Wow. I’m shocked. I never thought it could be this simple. Next you’ll tell me to brush my teeth before bed. 🙄

Also, I’m 37. I don’t have time to be a pharmacy detective. But hey, if you want to spend your life calling PBMs, go ahead. I’ll be here, taking my meds… and paying $400 for them. Because apparently, I’m the problem.

Every human being deserves access to life-saving medication. This is not a privilege. It is a right. The fact that we must navigate a labyrinth of hidden networks, corporate middlemen, and silent billing traps to obtain basic health care is a moral failure.

But even in this broken system, you hold power. You can ask. You can verify. You can refuse to accept the unjust. You can call, email, file complaints, and share your story. Your voice matters. Your health matters.

Do not let fear silence you. Do not let confusion paralyze you. Take one step today. Check one pharmacy. Call one number. You are not powerless. You are human. And you deserve to live.

With deep respect and solidarity.

You people are so naive. You think checking a list fixes anything? The system is designed to trap you. The PBM changes networks monthly. The app is outdated. The pharmacist doesn’t know anything. The ‘in-network’ pharmacy you find? It’s probably a shell location with no staff. You’ll drive 40 miles for a $12 pill and they’ll be closed.

And you think calling them helps? They’ll transfer you to 3 departments and hang up. You’re wasting your time. The only real solution is to stop taking the meds. Or get a second job. Or move to a country with actual healthcare.

Stop pretending this is fixable. It’s not. You’re just being manipulated to feel like you’re in control. You’re not.

USA! USA! USA! We don’t need no foreign healthcare! We got the best system in the world! You think Canada’s got specialty drugs? Nah. They ration ‘em. We got choice! We got competition! We got PBMs making sure you pay full price so the rich can buy more yachts!

And if you can’t afford your meds? Then maybe you shouldn’t have gotten sick! That’s the American way! Work harder! Save more! Don’t be lazy! My grandpa worked 3 jobs and never needed insulin!

Also, you should’ve checked the list. You didn’t? Then you’re just a loser. #MakeAmericaPayAgain

What’s the point of even discussing this? The entire system is a Ponzi scheme built on the backs of the working class. PBMs are not ‘managers’-they’re rent-seekers. Insurance companies are not ‘providers’-they’re toll collectors. And you? You’re the mule.

People who ‘check the list’ are delusional. The list changes daily. The app crashes. The pharmacy doesn’t know. The PBM lies. The government is bought.

There is no solution. Only survival. And survival means avoiding the system entirely. Don’t get sick. Don’t take meds. Don’t trust anyone. That’s the only rational choice in a world where healthcare is a commodity.

Enjoy your life while you still can.

Okay so I just did this thing and I’m so proud of myself 🥹 I’ve been on a $2,000/month med for 2 years and I never checked the pharmacy network. I thought my local CVS was fine. Turns out it wasn’t. I paid $1,800 last month. I cried. I yelled. I screamed into a pillow.

Then I downloaded the OptumRx app. Found the in-network specialty pharmacy 10 minutes away. Called them. They mailed me a 90-day supply for $150. I cried again. But this time happy tears.

So yeah. It’s a pain. But it’s worth it. Don’t wait like I did. Do it now. Your future self will thank you. And if you’re scared? Message me. I’ll help. No judgment. We’re all just trying to stay alive here 💙

Look, I’ve been doing this for 15 years. I know every PBM, every loophole, every trick. You think checking the list helps? Nah. They change the network every 72 hours. The app is a lie. The pharmacist is told to say ‘yes’ even when it’s no.

Here’s what actually works: go to the pharmacy, pay full price, then file a complaint with your state AG. Most PBMs will reverse it to avoid scrutiny. They hate paperwork more than they hate you.

Also, never use the PBM app. Use GoodRx. It’s cheaper than your ‘in-network’ price 80% of the time. And no, I’m not sponsored. I just don’t want you to get screwed.

And if you’re on a specialty drug? You’re already screwed. Just accept it. Buy your meds on the dark web. I’ve done it. Works fine.